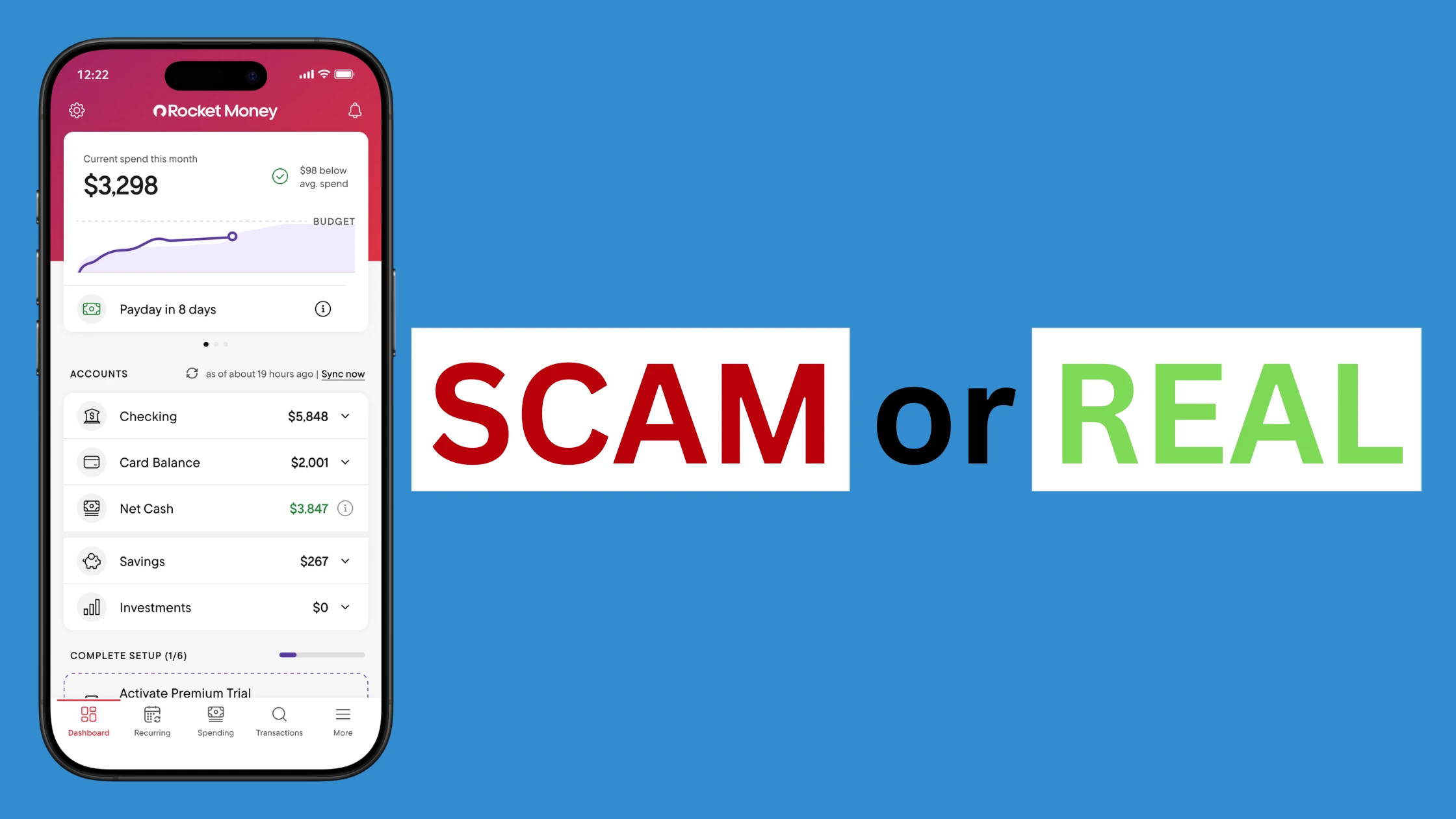

Rocket Money Review: Is it legit or scam?

Shamatic is proud to bring you this Rocket Money Review to help you truly understand why Rocket Money is getting so much attention and why users are flocking to it. If you’ve ever wondered whether Rocket Money is worth your time, if it’s safe, or if it really delivers on its promises, you’re in the right place.

This blog will answer your burning questions, help you judge the legitimacy of Rocket Money, and give you a clear, friendly guide to everything you need to know in 2025. With so many financial apps out there, it’s crucial to know which ones are legit and which ones to avoid. That’s why we’ve made this Rocket Money review 2025-focused, digestible, and packed with the latest stats and user experiences.

What is Rocket Money? Your All-in-One Finance Assistant

Rocket Money (https://www.rocketmoney.com/) is a personal finance platform designed to help you manage your money smarter. With over 5 million members and more than $1 billion saved for users over the past five years, Rocket Money has become a go-to app for tracking spending, canceling unwanted subscriptions, negotiating bills, and building better budgets. The platform’s mission is simple: empower you to take control of your financial life without the stress and confusion that often comes with managing money.

Rocket Money operates by securely linking to your bank, credit card, and investment accounts. It automatically tracks your transactions, identifies recurring expenses, and highlights opportunities to save. You get a full picture of your financial health in one place, along with tools to help you reach your goals. The company’s vision is to make personal finance accessible and actionable for everyone, regardless of background or experience.

Rocket Money Score on TrustPilot and Scamadviser

When you’re deciding if a platform is safe, you want to check what real users and independent reviewers say. On TrustPilot, Rocket Money scores a solid 4.3 out of 5 stars, based on thousands of reviews as of 2025. Most users praise its subscription management, bill negotiation, and easy-to-use interface. On Scamadviser, Rocket Money is rated as “Legit” with a trust score of 100/100, reflecting its transparency, secure operations, and positive reputation. You can see more on TrustPilot and Scamadviser.

History of Rocket Money: From Start-Up to Industry Leader

Rocket Money began its journey as Truebill in 2015, founded by brothers Yahya, Haroon, and Idris Mokhtarzada. Their goal was to help people identify and cancel unwanted subscriptions, a pain point for many. Over time, Truebill expanded its features to include budgeting, bill negotiation, and financial insights. In late 2022, Truebill was acquired by Rocket Companies (the parent company of Rocket Mortgage) and rebranded as Rocket Money.

Since then, Rocket Money has grown rapidly, now serving over 5 million users and saving billions for its members. The platform has evolved into a full-fledged financial assistant, offering everything from credit score tracking to automated savings. Today, Rocket Money stands as one of the most trusted names in personal finance management.

Rocket Money’s headquarters are located in Silver Spring, Maryland, USA. The official address is:

Rocket Money, Inc.

8121 Georgia Ave, Suite 500

Silver Spring, MD 20910

United States

For customer support, you can reach out via their Contact Page or email support@rocketmoney.com. They also offer in-app support for users.

Rocket Money boasts a diverse team of over 200 professionals, including engineers, product managers, customer support specialists, financial advisors, and data scientists. The team works together to deliver a seamless user experience, ensuring that every feature is intuitive and effective.

You’ll find dedicated bill negotiation experts, subscription cancellation specialists, and savings advisors who work directly with users. The platform also employs cybersecurity experts to keep your data safe. The company culture emphasizes transparency, innovation, and a genuine desire to help users improve their financial lives.

Features and Benefits: What Makes Rocket Money Stand Out?

Subscription Management

Rocket Money’s subscription management tool automatically scans your linked accounts to find recurring charges. It highlights subscriptions you might have forgotten about and lets you cancel them with a single tap. This feature has saved users millions by eliminating unwanted expenses.

Bill Negotiation

One of Rocket Money’s standout features is its bill negotiation service. Their team contacts service providers on your behalf to negotiate lower rates for bills like cable, internet, and phone. You only pay a percentage of the savings, so there’s no risk if they can’t save you money.

Automated Savings

Rocket Money helps you build your savings effortlessly. You can set up automated transfers to a savings account, and the app uses smart algorithms to determine how much you can safely save each week. This helps you reach your goals without feeling the pinch.

Budgeting Tools

The budgeting feature lets you set spending limits by category, track your progress, and get alerts when you’re close to overspending. The intuitive dashboard makes it easy to see where your money is going and adjust your habits.

Credit Score Tracking

Rocket Money provides access to your credit report and monitors changes in your score. You get alerts for important updates, helping you stay on top of your credit health and spot potential fraud early.

Net Worth Tracking

Want to see your full financial picture? Rocket Money calculates your net worth by adding up your assets and subtracting your debts. This feature helps you track progress over time and make smarter financial decisions.

Shared Accounts

If you manage money with a partner or family, Rocket Money allows you to share accounts and budgets. This makes it easier to coordinate spending, savings, and financial goals.

Real-Time Balance Alerts

Never get caught off guard by a low balance again. Rocket Money sends real-time alerts when your checking account drops below a safe level or when you’re about to exceed your budget.

Customizable Categories

You can personalize your spending categories, making the app fit your unique lifestyle. Whether you want to track pet expenses or vacation funds, Rocket Money adapts to your needs.

Human Support

With Rocket Money Premium, you get access to real people who can help you cancel subscriptions, negotiate bills, and answer financial questions. This personal touch sets Rocket Money apart from many competitors.

Is Rocket Money Scam or Legit? Let’s Break It Down

1. Backed by Rocket Companies

Rocket Money is owned by Rocket Companies, Inc. (NYSE: RKT), a publicly traded financial services giant. This backing adds credibility and ensures regulatory compliance, making it highly unlikely to be a scam.

2. Millions of Satisfied Users

With over 5 million members and $1 billion in reported savings, Rocket Money has a proven track record. Thousands of positive Rocket Money reviews confirm that users find real value in the platform.

3. Transparent Pricing

Rocket Money is upfront about its pricing. The core features are free, and premium services are clearly explained. You only pay for bill negotiation if they save you money, which eliminates hidden fees.

4. Secure Data Practices

The platform uses bank-level encryption and partners with trusted financial institutions. Your data is never sold to third parties, and you can read more about their security practices on their security page.

5. Positive Independent Ratings

As mentioned earlier, Rocket Money scores highly on TrustPilot and Scamadviser, with no major red flags or scam reports. These independent sources help answer the question, “Is Rocket Money legit?”

6. Real Customer Support

Unlike many scam websites, Rocket Money offers real customer support through multiple channels, including in-app chat, email, and a detailed help center.

7. Media Recognition

Rocket Money has been featured in reputable publications like Forbes and CNBC, further validating its legitimacy.

8. Regulatory Compliance

As part of Rocket Companies, Rocket Money complies with U.S. financial regulations and partners with FDIC-insured banks for its banking features.

What’s New in Rocket Money 2025?

Rocket Money has rolled out several exciting updates in 2025. The platform now offers enhanced net worth tracking, allowing you to include assets like real estate and vehicles. The budgeting tool has been upgraded with AI-powered insights, giving you smarter suggestions for saving and spending. Rocket Money also introduced the Rocket Card, a credit card that offers up to 5% cash back in mortgage savings, making it easier for users to reach homeownership goals. The app’s interface has been refreshed for a smoother user experience, and customer support has expanded with more live agents available during peak hours.

How to Earn on Rocket Money

1. Bill Negotiation Savings

Rocket Money’s bill negotiation team works to lower your monthly bills. When they succeed, you keep the majority of the savings. For example, if they reduce your cable bill by $20 per month, you save $240 a year.

2. Subscription Cancellations

By identifying and canceling unused subscriptions, you can save hundreds of dollars annually. Rocket Money does the heavy lifting, so you don’t have to chase down companies yourself.

3. Automated Savings

The automated savings feature helps you stash away extra cash without thinking about it. Over time, these small, regular deposits add up, helping you build an emergency fund or save for big goals.

4. Cashback with Rocket Card

The new Rocket Card offers up to 5% cash back in mortgage savings on every purchase. This unique feature helps you earn rewards that can be applied toward your home loan, making everyday spending work for you.

5. Budget Optimization

By tracking your spending and setting realistic budgets, you can identify areas to cut back and redirect those funds to savings or investments.

How to Get Started with Rocket Money

Getting started with Rocket Money is simple:

- Visit the Website: Go to www.rocketmoney.com.

- Sign Up: Click “Get Started” and enter your email address to create an account.

- Link Your Accounts: Securely connect your bank, credit card, and investment accounts.

- Set Up Your Profile: Answer a few questions about your financial goals and preferences.

- Explore Features: Use the dashboard to track spending, manage subscriptions, and set budgets.

- Upgrade (Optional): Try Rocket Money Premium for advanced features like bill negotiation and human support.

- Start Saving: Follow the app’s suggestions and watch your savings grow.

User Reviews and Testimonials

Rocket Money has received thousands of positive reviews from real users. Here are a few highlights:

- Jessica O.: “Rocket Money saved me over $200 in the first week alone! I realized I still had a subscription that I thought had been canceled, and when I contacted the merchant they refunded me.”

- Peter Z.: “This is kind of wild. Also, I was wrong. Rocket Money is significantly better than Mint.”

- Michelle G.: “The Rocket Money app has been a gamechanger. It has helped me cancel subscriptions I didn’t know I had. It is also helping me stay on track with my spending and budgeting. 10/10!”

- Casey R.: “Quintessential money management app. Nothing but high remarks from me. The app has only gotten better from when I first used it. Cannot recommend it enough.”

Conclusion: Is Rocket Money Fake or Real?

After a deep look at the features, user feedback, and independent ratings, we can say that Rocket Money is real and trustworthy. With millions of users, strong backing from Rocket Companies, and top marks from review sites, Rocket Money stands out as a legitimate and safe choice for managing your finances. If you’re asking, “Is Rocket Money safe?” or “Is Rocket Money scam or legit?”-the answer is yes, it’s safe and legit. You can confidently use Rocket Money to simplify your financial life and save money.

FAQs

What is Rocket Money?

Rocket Money is a personal finance app that helps you track spending, manage subscriptions, negotiate bills, and build savings-all in one place.

Is Rocket Money Safe?

Yes, Rocket Money uses bank-level encryption and does not sell your data. It is backed by Rocket Companies and partners with FDIC-insured banks.

How much does Rocket Money cost?

The core features are free. Premium features, like bill negotiation and human support, are available for a monthly fee starting at $3 to $12.

Can Rocket Money really save me money?

Absolutely. Users have reported saving hundreds to thousands of dollars per year through subscription cancellations, bill negotiation, and budgeting tools.

Is Rocket Money legit?

Yes, Rocket Money is a legitimate platform with millions of users and high ratings on TrustPilot and Scamadviser.

How does Rocket Money compare to Mint?

Many users say Rocket Money is easier to use and offers more hands-on support, especially for subscription management and bill negotiation.

Who owns Rocket Money?

Rocket Money is owned by Rocket Companies, Inc. (NYSE: RKT), a leading financial services company.

Can I use Rocket Money on my phone?

Yes, Rocket Money is available on iOS and Android, as well as on the web.

What are the main ways to earn or save with Rocket Money?

You can save money by canceling unused subscriptions, negotiating bills, automating savings, and earning cash back with the Rocket Card.

Where can I read more Rocket Money reviews?

Check out TrustPilot and Forbes for more Rocket Money reviews.

If you’re ready to take control of your finances, Rocket Money can be a smart, safe, and user-friendly choice for 2025.